4550 registration fee plus tag fee in addition to personal property taxes and sales tax. 1949 VEHICLES OR OLDER. Kansas sales tax antique cars.

Kansas Sales Tax Antique Cars, Under current Kansas law there is financial incentive for owners of antique cars and trucks to get an antique tag. Classics on Autotrader has a huge selection of classic cars muscle cars rare and exotic vehicles and more. There are also local taxes up to 1 which will vary depending on region. Risk and rewards of ownership.

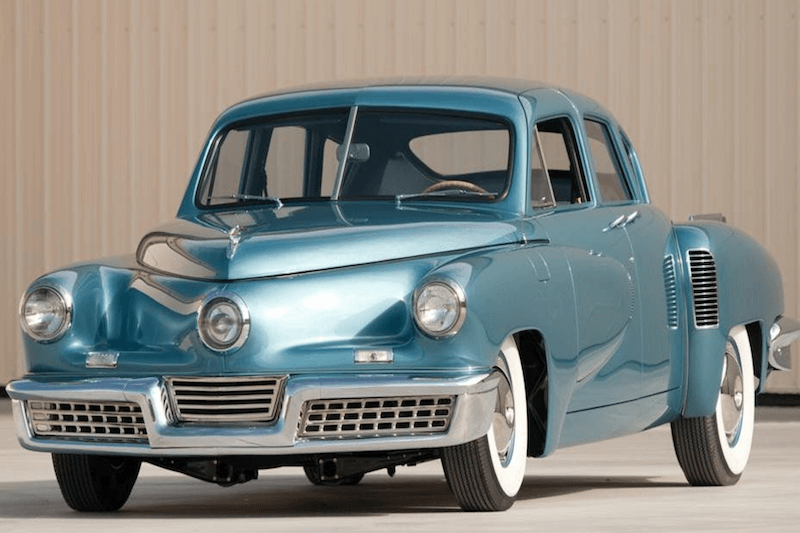

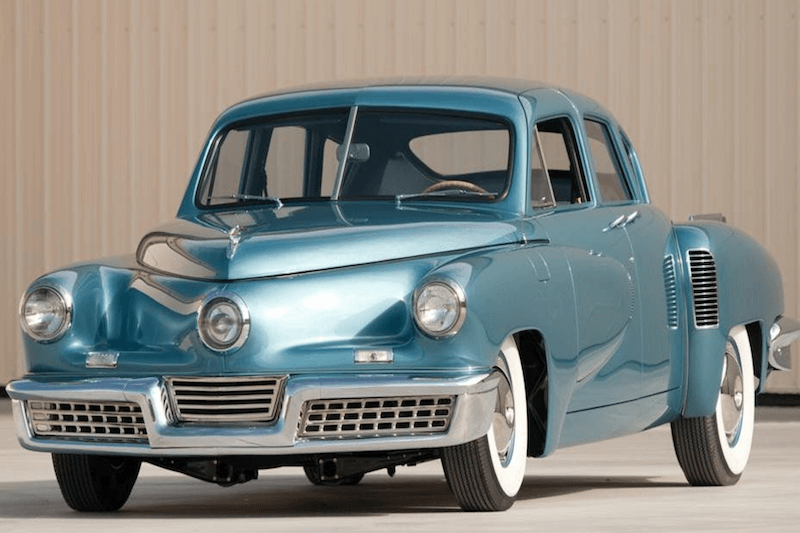

Title Registration Classic Cars Vs Antiques Vs Vintage Etags Vehicle Registration Title Services Driven By Technology From etags.com

Title Registration Classic Cars Vs Antiques Vs Vintage Etags Vehicle Registration Title Services Driven By Technology From etags.com

111 S Cherry St Olathe KS 66061 913-715-5000 TDD. Classics on Autotrader has a huge selection of classic cars muscle cars rare and exotic vehicles and more. Andover KS Sales Tax Rate. Shop millions of cars from over 21000 dealers and find the perfect car.

Total Sales Tax Rate.

Read another article:

Or a classic American muscle car hot rods or some other type of old car. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. There are also local taxes up to 1 which will vary depending on region. 4000 registration fee is a one-time fee. Sales tax receipt if vehicle was purchased from a dealer if not sales tax.

Source: quotesgram.com

Source: quotesgram.com

Owners of these vehicles pay a one-time 40 registration fee and 17 annually in. Antique vehicles 1950 or newer sold on a bill of sale require an inspection. In most cases the tax is fixed at 1200. Total Sales Tax Rate. Quotes About Old Cars Quotesgram.

Source: insider.hagerty.com

Source: insider.hagerty.com

Standard antique registrationlicense plate fee is a one-time 40 fee. Antique license plates do not need to be renewed property taxes will still be due annually. Annual registration is 1700 after plate is issued. If a personalized antique plate is requested there will be an 4550 charge in addition to the 40 registration fee. What Green Regulations Could Mean For Classics Hagerty Insider.

Source: pinterest.com

Source: pinterest.com

1972 Pontiac Lemans GT. When obtaining antique car license plates in Kansas drivers will. In most cases the tax is fixed at 1200. The pink copy of the MVE-1 must be submitted to the treasurers office. Directory Index Amc Ads 1960 Rambler Amc Car Ads Rambler.

Source: pinterest.com

Source: pinterest.com

Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from sales tax and vehicles used for certain types of forestry and agriculture are as well. When obtaining antique car license plates in Kansas drivers will. The annual tax shall be due when other similar vehicle types become subject to re-registration. 4000 registration fee is a one-time fee. Cheap Ebay Used Cars For Sale In 2021 Cars For Sale Automatic Cars For Sale Used Cars.

Source: thenewswheel.com

Source: thenewswheel.com

Sales tax rates in the county currently range from 7725 to 9725from which 1225 comes to Johnson County Government 65 goes to the state of Kansas and between 1 and 2 go to the city where the purchase is made. 1972 Pontiac LeMans GT I bought this car in Cheyenne Wyoming a couple of years ago. 4000 registration fee is a one-time fee. The sales tax is reasonable at 45 percent but theres also a steep excise tax of 45 percent that makes this one of the most tax-heavy states in the Union when it comes to registering a car. What Are Historic License Plates How To Get One For Your Car The News Wheel.

Source: pinterest.com

Source: pinterest.com

Current proof of insurance. Total Sales Tax Rate. El Dorado KS 67042 Owners of registered antique vehicles are subject to an annual property tax payment and when the owner intends to commence operations of the vehicle on the highways of Kansas. Andover KS Sales Tax Rate. Epingle Sur Cars.

Source: issuu.com

Source: issuu.com

4000 registration fee is a one-time fee. The annual tax shall be due when other similar vehicle types become subject to re-registration. Andover KS Sales Tax Rate. El Dorado KS 67042 Owners of registered antique vehicles are subject to an annual property tax payment and when the owner intends to commence operations of the vehicle on the highways of Kansas. An Auction Of Vintage Classic Cars By Handhclassics Issuu.

Source: pinterest.com

Source: pinterest.com

Current proof of insurance. Search Results and Filters - Now Faster More Powerful. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Antique vehicles are taxed annually as personal property just as any other vehicle. 1947 Hudson Super 8 Antique Cars Old Classic Cars Vintage Cars.

Source: gatewayclassiccars.com

Source: gatewayclassiccars.com

If the upcoming hike in state sales tax has you thinking about shopping for a vehicle out-of-state dont botherIt does not matter where you buy it if you tag a vehicle in Kansas you will pay. 1972 Pontiac LeMans GT I bought this car in Cheyenne Wyoming a couple of years ago. Pete Jakes power coated frame- grand Am Bucket Seats-Gasser Wheels on Front-Et wheels on rear. Pin On Classic Cars. 1934 Ford Pickup Tow Truck Holmes 485 For Sale Gateway Classic Cars 25132.

Source: br.pinterest.com

Source: br.pinterest.com

Andover KS Sales Tax Rate. Derby KS Sales Tax Rate. Standard antique registrationlicense plate fee is a one-time 40 fee. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Someone Paid Only 5 400 For This 1955 Armstrong Siddeley Sapphire 346 Carscoops Classic Cars British Classic Cars Singer Cars.

Source: pinterest.com

Source: pinterest.com

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Or a classic American muscle car hot rods or some other type of old car. The annual tax shall be due when other similar vehicle types become subject to re-registration. Search Results and Filters - Now Faster More Powerful. Pin On Little Trucks.

Source: business-standard.com

Source: business-standard.com

Antique vehicles are taxed annually as personal property just as any other vehicle. Under the bill any car more than 35 years old would be eligible for antique registration regardless of any updates made to the car or the age of parts on the car. Sales tax may also be due at the time you title and register the vehicle. 1972 Pontiac LeMans GT I bought this car in Cheyenne Wyoming a couple of years ago. The Time Travellers Business Standard News.

Source: etags.com

Source: etags.com

Sales tax rates in the county currently range from 7725 to 9725from which 1225 comes to Johnson County Government 65 goes to the state of Kansas and between 1 and 2 go to the city where the purchase is made. Dodge City KS Sales Tax Rate. When obtaining antique car license plates in Kansas drivers will. In most cases the tax is fixed at 1200. Title Registration Classic Cars Vs Antiques Vs Vintage Etags Vehicle Registration Title Services Driven By Technology.

Source: gatewayclassiccars.com

Source: gatewayclassiccars.com

El Dorado KS 67042 Owners of registered antique vehicles are subject to an annual property tax payment and when the owner intends to commence operations of the vehicle on the highways of Kansas. If a personalized antique plate is requested there will be an 4550 charge in addition to the 40 registration fee. The pink copy of the MVE-1 must be submitted to the treasurers office. Owners of these vehicles pay a one-time 40 registration fee and 17 annually in. 1950 Lincoln Sport Sedan For Sale Gateway Classic Cars 25049.

Source: pinterest.com

Source: pinterest.com

Sales tax is required to be charged on each installment unless the entire lease price is. In most cases the tax is fixed at 1200. 111 S Cherry St Olathe KS 66061 913-715-5000 TDD. Antique license plates do not need to be renewed property taxes will still be due annually. 1964 Rambler Ambassador 440 Convertible Blue Original 13 5 10 5 Magazine Ad In 2021 Rambler Car Ads Convertible.