Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle. You will have to show proof to DMV that you own or have use of company car. Personal property tax on antique car tag laws va.

Personal Property Tax On Antique Car Tag Laws Va, No limits on mileage or anything like that. The bill was signed by Gov George Allen at that time. If you have questions about personal property tax or real estate tax contact your local tax office. The owner of the vehicle cannot renew tags state decals or vehicle registration until the taxes have been paid.

Virginia Department Of Motor Vehicles From dmv.virginia.gov

Virginia Department Of Motor Vehicles From dmv.virginia.gov

Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle. The issuance of West Virginia classic car license plates generally requires applicants to complete an application form including personal information as well as details about the vehicle in question make year title and vehicle identification number and more. The owner of the vehicle cannot renew tags state decals or vehicle registration until the taxes have been paid. The Fairfax City Council has adopted a lower personal property tax rate of 001 per 100 of assessed value on one motor vehicle owned and regularly used by a qualifying disabled veteran in accordance with Virginia Code 581-3506A19.

If however when not in service the vehicle is normally garaged at a Virginia residence and used in Virginia for personal use that vehicle is subject to the countys personal property tax and is required to display dual license plates ie it must display plates from both DC and Virginia at the same time.

Read another article:

Vehicle sales and use tax is 3 of the sale price. Pursuant to VA Code 462-730 owners of an antique vehicle must complete a VSA 10 B Antique License Plate Applicant Certification Form have it notarized and submit it to the Virginia Department of Motor Vehicles. The registration fee will vary based on the vehicle type and weight. No limits on mileage or anything like that. For tax purposes cars with antique plates have a maximum valuation of 500.

Source: dmv.virginia.gov

Source: dmv.virginia.gov

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. The VSA 10 B form may be downloaded in PDF format at wwwdmvvirginiagov. The answer is with antique plates you pay a 1 time fee of 50 for registration and a 1 time fee of 10 for personal property tax. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. Virginia Department Of Motor Vehicles.

Source: dmv.virginia.gov

Source: dmv.virginia.gov

Jul 14 2013. The VSA 10 B form may be downloaded in PDF format at wwwdmvvirginiagov. Tax rates differ depending on where you live. Lease etc a normally registered car other than the antique. Virginia Department Of Motor Vehicles.

Source: marioncountywv.com

Source: marioncountywv.com

The answer is with antique plates you pay a 1 time fee of 50 for registration and a 1 time fee of 10 for personal property tax. The owner must certify that the antique vehicle meets the safety equipment requirements for its model. 333 recognizes that existing antique motor vehicles and classic cars constitute a small portion of the vehicle fleet and are well-maintained infrequently operated hobby cars and deserving of tax benefits. The answer is with antique plates you pay a 1 time fee of 50 for registration and a 1 time fee of 10 for personal property tax. Personal Property Assessment.

Source: pinterest.com

Source: pinterest.com

Loudoun County levies a tax each calendar year on all motor vehicles trailers campers mobile homes boats and airplanes with situs in the county. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Thats a massive savings if your emotions ran high at one of the Arizona auctions and you came home with a 50000 car. Personal Property Relief Act 1998 PPTRA Under Virginia law the Commonwealth of Virginia subsidizes a percentage of the tax on the first 20000 of assessed value for vehicles coded as personal use. Alabama 7 Day Eviction Notice To Quit Non Payment Of Rent Eforms Free Fillable Forms Eviction Notice Lettering Letter Example.

Source: pinterest.com

Source: pinterest.com

The registration fee will vary based on the vehicle type and weight. This will depend upon the value of the car at the first of the year. To anyone needing an answer to personal property tax on antique vehilcles in Va. Virginia taxes your automobiles every year as a property tax. Pin On India S First Financial Helpline Dial A Bank.

Source: staffordcountyva.gov

Source: staffordcountyva.gov

Page Content Please input the value of the vehicle the number of months that you owned it during the tax year and click the Calculate button to compute the tax. 333 recognizes that existing antique motor vehicles and classic cars constitute a small portion of the vehicle fleet and are well-maintained infrequently operated hobby cars and deserving of tax benefits. The Fairfax City Council has adopted a lower personal property tax rate of 001 per 100 of assessed value on one motor vehicle owned and regularly used by a qualifying disabled veteran in accordance with Virginia Code 581-3506A19. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Stafford County Va.

Source: buncombecounty.org

Source: buncombecounty.org

Tax rates differ depending on where you live. However if you order standard vintage vehicle tags you will be required to pay the registration renewal fee on a regular basis. The owner must certify that the antique vehicle meets the safety equipment requirements for its model. Personal Property Staff Phone. Personal Property Buncombe County Asheville.

Source: pinterest.com

Source: pinterest.com

View qualifications and procedures for appealing your vehicle assessment on your vehicle. The VSA 10 B form may be downloaded in PDF format at wwwdmvvirginiagov. To register your vehicle with antique or permanent vintage license plates DMV charges a one-time 50 registration fee. However if you order standard vintage vehicle tags you will be required to pay the registration renewal fee on a regular basis. Personal Web Designer Portfolio Wordpress Theme Designer Web Personal Portfolio Web Design Wordpress Theme Portfolio Web Design.

Source: dmv.virginia.gov

Source: dmv.virginia.gov

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. 333 recognizes that existing antique motor vehicles and classic cars constitute a small portion of the vehicle fleet and are well-maintained infrequently operated hobby cars and deserving of tax benefits. No limits on mileage or anything like that. Your license plates will be valid for as long as you own the vehicle. Virginia Department Of Motor Vehicles.

To register your vehicle with antique or permanent vintage license plates DMV charges a one-time 50 registration fee. Loudoun County levies a tax each calendar year on all motor vehicles trailers campers mobile homes boats and airplanes with situs in the county. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Tax rates differ depending on where you live. Personal Property Frederick County.

A higher-valued property pays more tax than a lower-valued property. Personal Property Staff Phone. 540 658-4120 Email Live Chat Office Hours. Personal use vehicles may be eligible for the Personal Property Tax Relief Act PPTRA. 2.

Source: caranddriver.com

Source: caranddriver.com

Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle. The issuance of West Virginia classic car license plates generally requires applicants to complete an application form including personal information as well as details about the vehicle in question make year title and vehicle identification number and more. 333 would exempt all vehicles 25 years old and older from personal property taxes. Vehicle Personal Property Tax. Virginia Sales Tax On Cars Everything You Need To Know.

A higher-valued property pays more tax than a lower-valued property. In CT once a car is 25 years old it is eligible for antique plates. On receipt of an application and evidence that the applicant owns or has regular use of another passenger car autocycle or motorcycle the Commissioner may authorize for use on antique motor vehicles and antique trailers Virginia license plates manufactured prior to 1976 and designed for use without decals if such license plates are embossed with or are of the same year of issue as the model year of the antique motor vehicle or antique. This will be a continuous tax to figure in your costs. Vehicle Registration Falls Church Va Official Website.

Source: pinterest.com

Source: pinterest.com

The owner of the vehicle cannot renew tags state decals or vehicle registration until the taxes have been paid. To register your vehicle with antique or permanent vintage license plates DMV charges a one-time 50 registration fee. Loudoun County levies a tax each calendar year on all motor vehicles trailers campers mobile homes boats and airplanes with situs in the county. Tax rates differ depending on where you live. Business License Certificate Frame Nv 8 5x11 Heavy Duty License Frames Certificate Frames Frame.

Source: rocketlawyer.com

Source: rocketlawyer.com

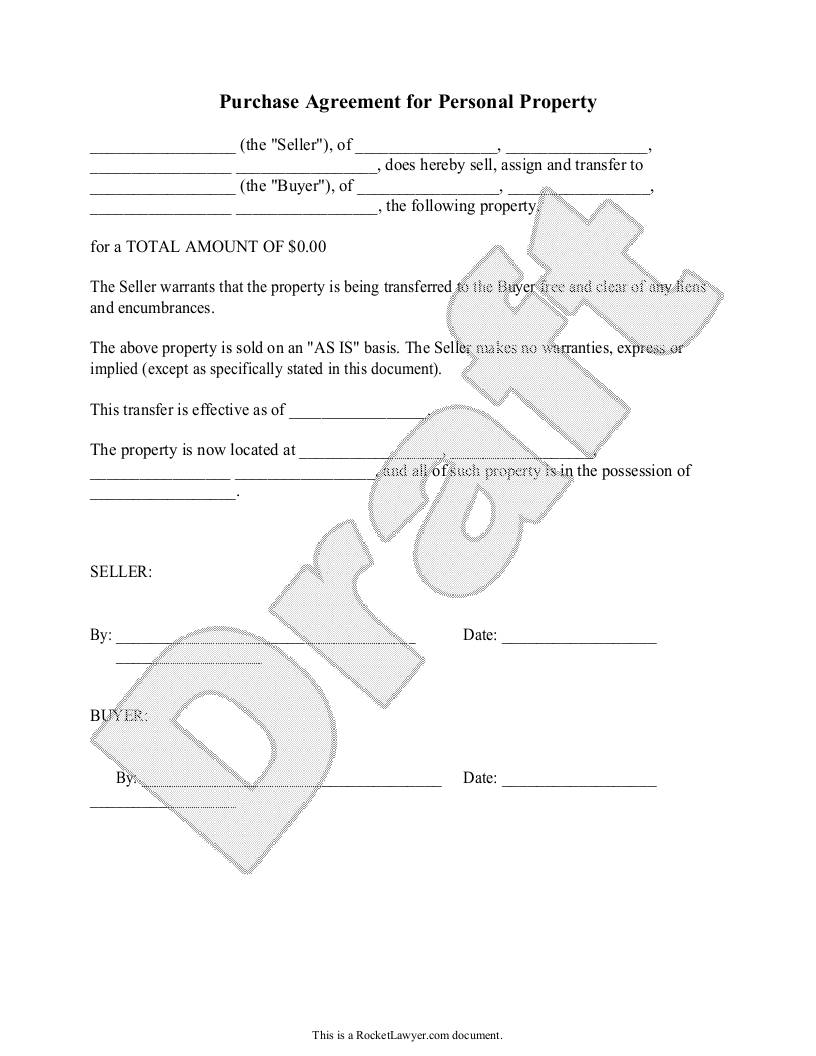

So if your car costs you 25000 you multiply that by 3 to get your tax amount of 75000. An additional processing fee of 20 per vehicle will be added to the taxes. Jul 14 2013. It is an ad valorem tax meaning the tax amount is set according to the value of the property. Free Purchase Agreement For Personal Property Free To Print Save Download.