Taking care of their beloved vehicle can be a joy for car lovers. The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. Rules of property tax concerning antique cars.

Rules Of Property Tax Concerning Antique Cars, An antique plate which states that the car can only be driven to and from events usually abused is 25 for five years. Rules of property tax concerning antique cars. Taking care of their beloved vehicle can be a joy for car lovers. An extended use plate is good for a couple of thousand miles a year but not in the winter months That has a yearly charge but it is much less than a regular car.

Q As Echa From echa.europa.eu

Q As Echa From echa.europa.eu

There are three tax cases that directly relate to car restorers and collectors. Existing law caps the value of antique motor vehicles for property tax assessment purposes at 500. Capital gains tax on collectibles. An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000.

Rules of property tax concerning antique cars.

Read another article:

2020 Check for updates Other versions. Capital gains tax on collectibles. An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000. To qualify a vehicle must meet the statutory criteria required for an antique rare or special interest vehicle license plate issued by the DMV. An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000.

Source: sgr.fi

Source: sgr.fi

- Antique automobiles are designated a special class of property under Article V Sec. A higher-valued property pays more tax than a lower-valued property. No NCTCRW required for Vintage Vehicles Insurance Details If the vehicle owner does not have the appropriate registration documents clearly showing the date of manufacture and the Motor Tax office is unable to trace any details of same from the National Vehicle Computer system then the vehicle will have to be re-registered with NCT and get a new Registration No. Antique motor vehicles are exempt from property tax. Materials On Forest Enets An Indigenous Language Of Northern Siberia.

Sales tax on a vintage car is a flat 125 fee plus 25 in a one-time tax regardless of how much you paid for the car. 2 2 of the north carolina constitution and must be assessed for taxation in accordance with this section. A property tax reduction or credit is available when a taxpayer sells a motor vehicle and does not replace it. An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000. 2.

Source: pinterest.com

Source: pinterest.com

Rules Of Property Tax Concerning Antique Cars In Nc. DEFINITION OF ANTIQUE VEHICLE FOR PROPERTY TAX PURPOSES. Rules Of Property Tax Concerning Antique Cars In Nc. However sometimes not all of the original documentation is available. Weekly Rental Agreement Template Luxury House Lease Agreement Template Microsoft Word Rental Agreement Templates Contract Template Lease Agreement.

Rules Of Property Tax Concerning Antique Cars In Nc. However sometimes not all of the original documentation is available. For example to successfully apply for antique vehicle tags car owners will have to pay a fee of 10 for the registration and license plate fee and a 15 certificate of title fee. It is an ad valorem tax meaning the tax amount is set according to the value of the property. 2.

DEFINITION OF ANTIQUE VEHICLE FOR PROPERTY TAX PURPOSES. Applicants who have not yet titled their antique vehicle will be required to pay additional fees. - Antique automobiles are designated a special class of property under Article V Sec. Antique motor vehicles are exempt from property tax. 2.

Source: researchgate.net

Source: researchgate.net

Antique motor vehicles are exempt from property tax. Property tax base value built-up area Age factor type of building category of use floor factor. An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000. An extended use plate is good for a couple of thousand miles a year but not in the winter months That has a yearly charge but it is much less than a regular car. Pdf Object And Objective Of Property Appraisal And Their Effects On Valuation Methods And Databases.

Source: mdpi.com

Source: mdpi.com

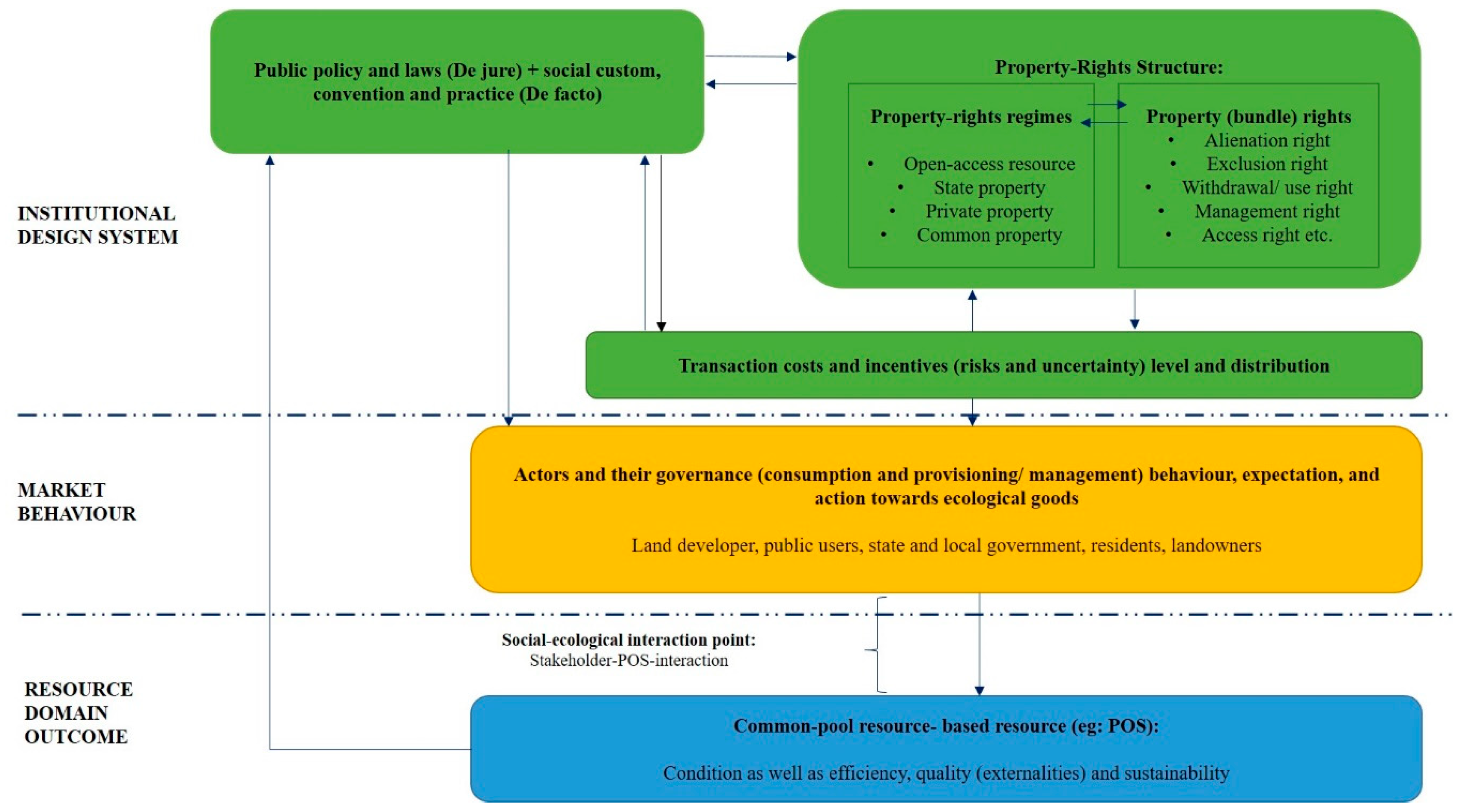

56 x 4 landscapefull color cmyk print processdouble sided printing for no additional cost 5 out of 5 stars. It is an ad valorem tax meaning the tax amount is set according to the value of the property. DEFINITION OF ANTIQUE VEHICLE FOR PROPERTY TAX PURPOSES. A vintage vehicle is a vehicle proved to be more than 30 years old. Economies Free Full Text Effects Of Diverse Property Rights On Rural Neighbourhood Public Open Space Pos Governance Evidence From Sabah Malaysia Html.

Source: pinterest.com

Source: pinterest.com

An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000. Personal property tax on antique car tag laws va. Ordinarily capital gains on property that has been held for at least one year are subject to either a 0 15 or 20 tax rate depending on your income however gains on collectibles such as cars are given a special 28 tax rate 1. A higher-valued property pays more tax than a lower-valued property. Washington Insurance Commissioner Complaint Diminished Value Car Appraisal Complaints Insurance Washington.

DEFINITION OF ANTIQUE VEHICLE FOR PROPERTY TAX PURPOSES. It is an ad valorem tax meaning the tax amount is set according to the value of the property. An antique plate which states that the car can only be driven to and from events usually abused is 25 for five years. Property tax in India depends on the location of a property in question with taxes varying from state to state. 2.

Source: mdpi.com

Source: mdpi.com

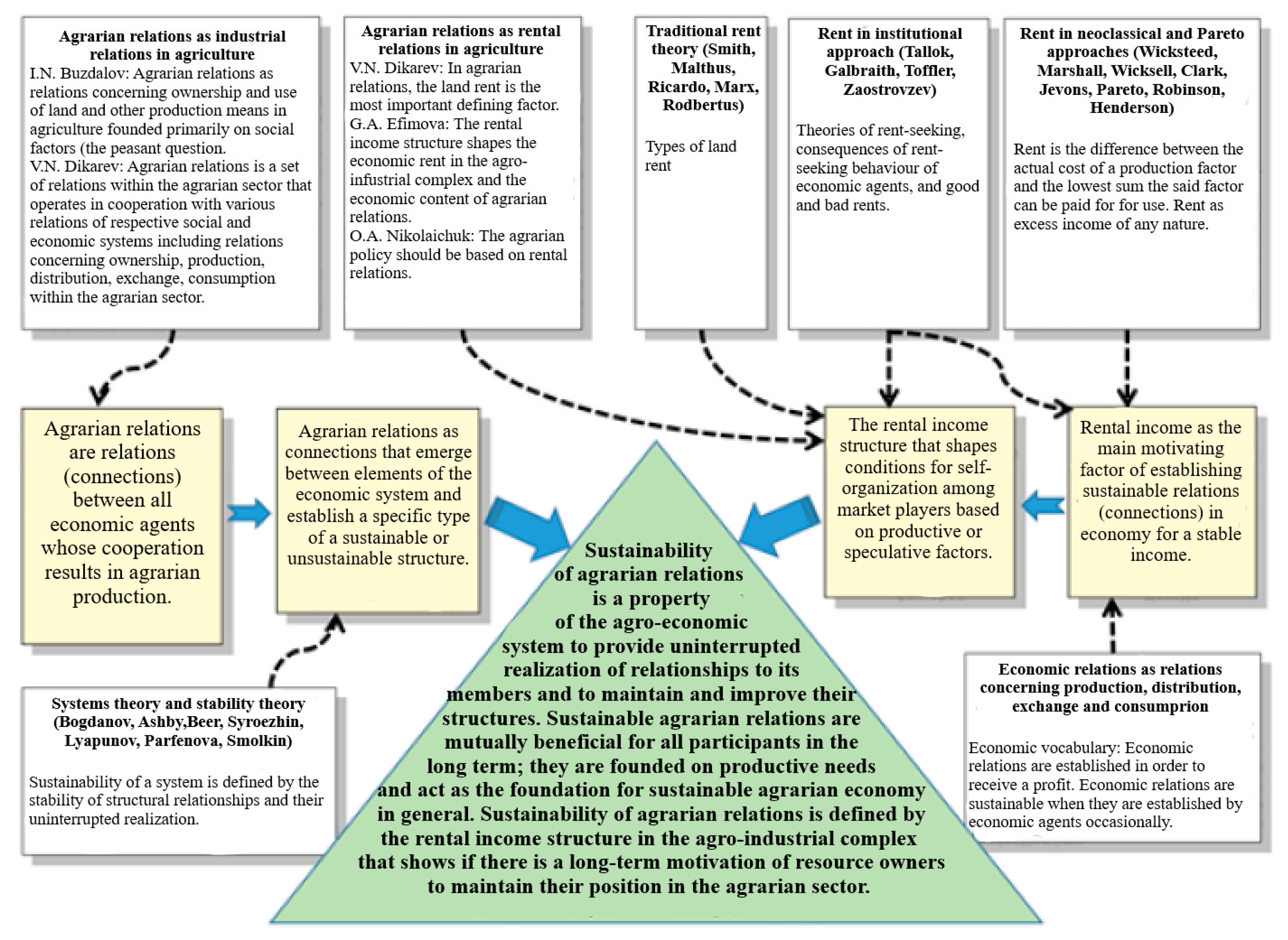

A property tax reduction or credit is available when a taxpayer sells a motor vehicle and does not replace it. - Antique automobiles are designated a special class of property under Article V Sec. Property tax base value built-up area Age factor type of building category of use floor factor. The bill requires the vehicles to be at least 25 years old to qualify for the cap. Sustainability Free Full Text Rental Income Structure In Economy As A Basis For Sustainable Agrarian Relations In The Agro Industrial Complex Html.

It is an ad valorem tax meaning the tax amount is set according to the value of the property. Antique vehicles must be insured with motor vehicle liability insurance or you must pay the uninsured motor vehicle fee. A vintage vehicle is a vehicle proved to be more than 30 years old. Antique motor vehicles are exempt from property tax. 2.

Source: ec.europa.eu

Source: ec.europa.eu

However sometimes not all of the original documentation is available. Vintage vehicles and ZV plates. If you do not register a motor vehicle but retain ownership you must annually file a declaration form with your assessor s between October 1 and November 1. The bill requires the vehicles to be at least 25 years old to qualify for the cap. Handbook On Quarterly National Accounts.

Source: researchgate.net

Source: researchgate.net

The formula used for calculating property tax is given below. The local property tax is computed and issued by your local tax collector. Antique vehicles must be insured with motor vehicle liability insurance or you must pay the uninsured motor vehicle fee. An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000. Pdf Social Cultural And Political Implications Of Intellectual Property Law In An Informational Economy.

Source: researchgate.net

Source: researchgate.net

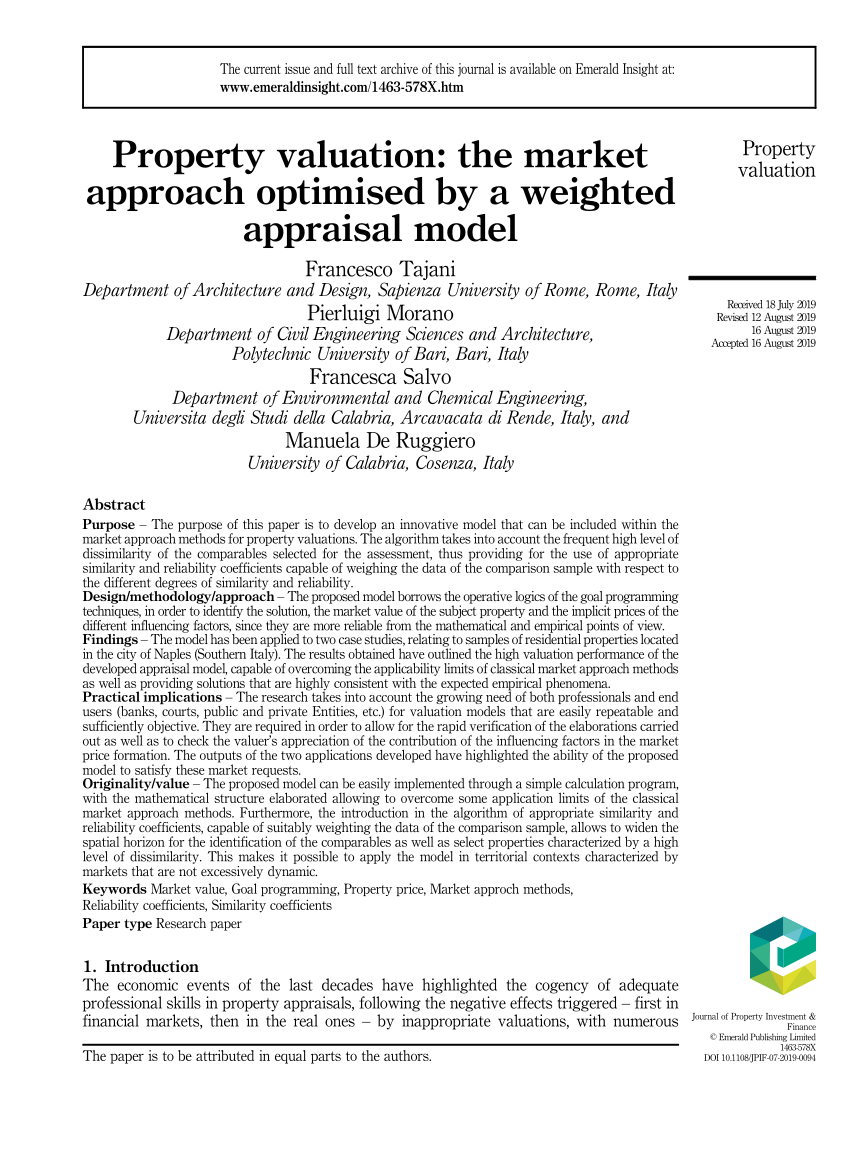

An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000. Rules Of Property Tax Concerning Antique Cars In Nc. The local property tax is computed and issued by your local tax collector. No NCTCRW required for Vintage Vehicles Insurance Details If the vehicle owner does not have the appropriate registration documents clearly showing the date of manufacture and the Motor Tax office is unable to trace any details of same from the National Vehicle Computer system then the vehicle will have to be re-registered with NCT and get a new Registration No. Pdf Property Valuation The Market Approach Optimised By A Weighted Appraisal Model.

Source: pinterest.com

Source: pinterest.com

The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. Taking care of their beloved vehicle can be a joy for car lovers. Property tax base value built-up area Age factor type of building category of use floor factor. - Antique automobiles are designated a special class of property under Article V Sec. Investment Property Expense List For Taxes Investing Investment Property Real Estate Business Plan.