The process of clearing occurs in between the time a trade is executed and a settlement is made. Start date jan 6, 2009.

Free Bank Clearing Date For Logo Design, You write a check in nov, and it doesn't get presented to the bank until jan = the wrong tax year for you. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another.

RBI Alert! New Rule For Cheque Payments From January 2021 Key Things From india.com

RBI Alert! New Rule For Cheque Payments From January 2021 Key Things From india.com

Nse clearing offers a settlement of funds through 13 clearing banks namely axis bank, bank of india, canara bank, citibank n.a, hdfc bank, hongkong & shanghai banking corporation, icici bank, idbi bank, indusind bank, kotak mahindra bank, standard chartered bank, state bank of india and union bank of india. Clearing is the process of settling transactions between banks in the financial system. In some cases (electronic payment) it may happen on the same date, while for other cases (paper check) it may take some additional time. However, the holidays will be applicable in only those states where the festivals are observed.

RBI Alert! New Rule For Cheque Payments From January 2021 Key Things Deposits of more than $5,000 usually take 4 business days to clear.

Clearing look at other dictionaries: The process of clearing occurs in between the time a trade is executed and a settlement is made. Clearing date shall be the date in which the estimated put shares (as defined in section 2.2 (a)) have been deposited into the investor 's brokerage account. If that's not fast enough, try asking customer service or a manager whether there's any.

Source: taklaganja.com

Source: taklaganja.com

Clearing is the procedure by which an organization acts as an intermediary and assumes the role of a buyer and seller in a transaction to reconcile orders between transacting parties. If that's not fast enough, try asking customer service or a manager whether there's any. You write a check in nov, and it doesn't get presented to the bank until jan = the wrong tax year for you. Clearing date means the first business day that the investor holds the purchase notice shares in its brokerage account. How to fill cheque properly for self withdrawal in India.

Source: india.com

Source: india.com

Clearing is similar to bookkeeping, where the clearing house updates the databases by. Start date jan 6, 2009. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Every day, millions of transactions occur, therefore bank clearance attempts to limit the sums that change hands. RBI Alert! New Rule For Cheque Payments From January 2021 Key Things.

Source: comtechsolutions.com

Source: comtechsolutions.com

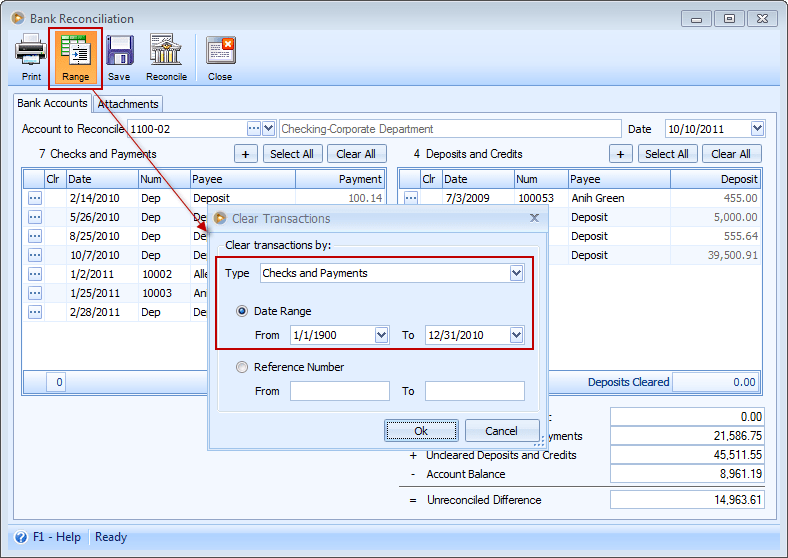

Bank reconcillation only for value date (clearing date) i have made outging payment based on a/p invoice and after 7 days i will get bank statement then i want to change only value date from bank statement so which type of posting mathod ( business partner from/to bank account,g/l account from/to bank account,bank interim account from/to bank. In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. Your bank often places a hold on deposits for five days or so, but in some cases, the funds become available more quickly. Clearing date shall be the date in which the estimated put shares (as defined in section 2.2 (a)) have been deposited into the investor 's brokerage account. Banking > Bank Reconciliation > Clear Transactions by Reference Number.

Source: lettersformats.com

Source: lettersformats.com

Every day, millions of transactions occur, therefore bank clearance attempts to limit the sums that change hands. Invoices which were posted on 10/10/1997 and on 10/15/1997 are cleared by a payment document which is posted on 11/10/1997. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Clearing date means the first business day that the investor holds the purchase notice shares in its brokerage account. Letter to Bank for Non Clearance of Cheque (Template).

Source: aplustopper.com

Source: aplustopper.com

Deposits of $5,000 or less usually clear within 3 business days. The interest rate will be at then fd interest rate. Scale at speed with confidence while we take care of clearing. Dynamicsdocs.com bank clearing standard «table 1280» bank clearing standard code [pk] description «table 1226. Letter to Bank Manager Format, Sample, Tips and Guidelines on How to.

Source: youtube.com

Source: youtube.com

Last date modified date filter global dimension 1 filter. Deposits of $5,000 or less usually clear within 3 business days. In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. Your check date is the date you spent it. Payment Cleared the Bank for a Different Amount YouTube.

Source: eduvark.com

Source: eduvark.com

Every day, millions of transactions occur, therefore bank clearance attempts to limit the sums that change hands. Deposits of $5,000 or less usually clear within 3 business days. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Punjab National Bank Education Loan Application Form Download 2021.

Source: lettersformats.com

Source: lettersformats.com

Cheque clearing understand when you should deposit your cheque to ensure that funds are made available in time. Clearing houses were formed to facilitate. Start date jan 6, 2009. Bank reconcillation only for value date (clearing date) i have made outging payment based on a/p invoice and after 7 days i will get bank statement then i want to change only value date from bank statement so which type of posting mathod ( business partner from/to bank account,g/l account from/to bank account,bank interim account from/to bank. Cheque Stop Payment Letter Format for Bank Sample.

Source: longforsuccess.com

Source: longforsuccess.com

Once a trade is executed or completed in a financial market, the clearing agency will be notified, who will then carry out the process of clearing the transaction. Scale at speed with confidence while we take care of clearing. The clearing date specifies as from when the item is to be regarded as cleared. Nse clearing offers a settlement of funds through 13 clearing banks namely axis bank, bank of india, canara bank, citibank n.a, hdfc bank, hongkong & shanghai banking corporation, icici bank, idbi bank, indusind bank, kotak mahindra bank, standard chartered bank, state bank of india and union bank of india. QuickBooks Tip Fixing Reconciliation Beginning Balance or Date Long.

Source: management.ind.in

Source: management.ind.in

Clearing is the procedure by which an organization acts as an intermediary and assumes the role of a buyer and seller in a transaction to reconcile orders between transacting parties. Your bank often places a hold on deposits for five days or so, but in some cases, the funds become available more quickly. Cleared date — date when a negotiable instrument (most commonly a cheque) becomes actually available for the payee to use. You write a check in nov, and it doesn't get presented to the bank until jan = the wrong tax year for you. ECS Form Yes Bank 2020 2021 Student Forum.

Source: templateroller.com

Source: templateroller.com

Deposits of more than $5,000 usually take 4 business days to clear. The following information applies to most of the banks in singapore such as dbs, ocbc, uob, maybank, standard chartered, etc. Cheque clearing (or check clearing in american english) or bank clearance is the process of moving cash (or its equivalent) from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. California Uncashed Check Notification Letter Template Download.

Source: gobankingrates.com

Source: gobankingrates.com

Scale at speed with confidence while we take care of clearing. Cheque clearing understand when you should deposit your cheque to ensure that funds are made available in time. Cheque clearing (or check clearing in american english) or bank clearance is the process of moving cash (or its equivalent) from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. Every day, millions of transactions occur, therefore bank clearance attempts to limit the sums that change hands. What Is a Cashier's Check and How Do I Get One? GOBankingRates.

Source: pinterest.com

Source: pinterest.com

The dbs/posb cheque deposit cut off time is 3.30 pm and the fund is usually available for use the following day after 2 pm. The clearing date specifies as from when the item is to be regarded as cleared. The dates when banks shall remain closed over the month are 1st, 8th, 13th, 14th, 15th, 16th, 19th, 20th. The bank date is the date they processed it, as part of verification on the way to reconciliation to confirm it cleared for the same amount that you thought you spent. Check Scan, Bank Processed, Stamps, dates, A check scan front/back.

Last date modified date filter global dimension 1 filter. Unit b, 25/f, mg tower, 133 hoi bun road, kwun tong, However, the holidays will be applicable in only those states where the festivals are observed. In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. Blank Check Illustrations, RoyaltyFree Vector Graphics & Clip Art iStock.

Source: comtechsolutions.com

Source: comtechsolutions.com

Clearing date means the date on which the shares clear. Cheque clearing (or check clearing in american english) or bank clearance is the process of moving cash (or its equivalent) from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. If the bank fails to clear the cheque within the mentioned period then the bank has to pay interest on the cheque amount. Banking > Bank Reconciliation > Clear Transactions by Reference Number.

Source: youtube.com

Source: youtube.com

Clearing is similar to bookkeeping, where the clearing house updates the databases by. Dynamicsdocs.com bank clearing standard «table 1280» bank clearing standard code [pk] description «table 1226. However, the holidays will be applicable in only those states where the festivals are observed. Cheque clearing understand when you should deposit your cheque to ensure that funds are made available in time. FCI Mains Date and Syllabus 2019 out clear your doubts By Banking.

Source: ecomparemo.com

Source: ecomparemo.com

Invoices which were posted on 10/10/1997 and on 10/15/1997 are cleared by a payment document which is posted on 11/10/1997. The dates when banks shall remain closed over the month are 1st, 8th, 13th, 14th, 15th, 16th, 19th, 20th. Unit b, 25/f, mg tower, 133 hoi bun road, kwun tong, If the bank fails to clear the cheque within the mentioned period then the bank has to pay interest on the cheque amount. Banks Issue Advisory On Check Clearing.

Source: support.parishsoft.com

Source: support.parishsoft.com

Unit b, 25/f, mg tower, 133 hoi bun road, kwun tong, If bank a owes bank b $2 million in cleared checks, but bank b owes bank a $1 million, bank a pays bank b just $1 million. The first $200 of the total check deposits will be. Clearing date shall be the date in which the estimated put shares (as defined in section 2.2 (a)) have been deposited into the investor 's brokerage account. PSA L&P Checks How to find out if a check has been cleared on a Bank.

Clearing date means the first business day that the investor holds the purchase notice shares in its brokerage account. Cleared date — date when a negotiable instrument (most commonly a cheque) becomes actually available for the payee to use. Once a trade is executed or completed in a financial market, the clearing agency will be notified, who will then carry out the process of clearing the transaction. The bank date is the date they processed it, as part of verification on the way to reconciliation to confirm it cleared for the same amount that you thought you spent. TechnoFunc Complete Bank Reconciliation Process.

Source: bartleby.com

Source: bartleby.com

If that's not fast enough, try asking customer service or a manager whether there's any. Cheque clearing (or check clearing in american english) or bank clearance is the process of moving cash (or its equivalent) from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. National clearing system code starts with 2 character length account identifier (2) iso20022 external account identification codes. Clearing is the procedure by which an organization acts as an intermediary and assumes the role of a buyer and seller in a transaction to reconcile orders between transacting parties. Answered Date Accounts and Explanation Debit… bartleby.

.png “What Does Post Dated Mean In Accounting Sap Correspondence Tutorial”) Source: allimage2026.blogspot.com

The process of clearing occurs in between the time a trade is executed and a settlement is made. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Because so many transactions take place between banks on a given day, bank clearing exists to process what each party owes or is owed in a central location so the least amount of money actually changes hands. The collection timing is as shown below: What Does Post Dated Mean In Accounting Sap Correspondence Tutorial.

![[Resolved] HDFC Bank — Post dated cheque cleared before date, how it [Resolved] HDFC Bank — Post dated cheque cleared before date, how it](https://i2.wp.com/www.consumercomplaints.in/thumb.php?complaints=1511480&src=595822950.jpg&wmax=900&hmax=900&quality=85&nocrop=1) Source: consumercomplaints.in

Source: consumercomplaints.in

Clearing houses were formed to facilitate. If that's not fast enough, try asking customer service or a manager whether there's any. A clearing bank is a banking institution that is a member of a national check clearing network that has the ability to approve or clear checks for payment, even if those checks are not written on accounts associated with that bank. Nse clearing offers a settlement of funds through 13 clearing banks namely axis bank, bank of india, canara bank, citibank n.a, hdfc bank, hongkong & shanghai banking corporation, icici bank, idbi bank, indusind bank, kotak mahindra bank, standard chartered bank, state bank of india and union bank of india. [Resolved] HDFC Bank — Post dated cheque cleared before date, how it.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

The interest rate will be at then fd interest rate. When clearing, the last posting date of all the documents involved in clearing is set as the clearing date. Unit b, 25/f, mg tower, 133 hoi bun road, kwun tong, For example, suppose bank a owes $1 million to bank b in cleared checks, but bank b. Oneday check clearing starts with electronic system ABSCBN News.

In some cases (electronic payment) it may happen on the same date, while for other cases (paper check) it may take some additional time. You write a check in nov, and it doesn't get presented to the bank until jan = the wrong tax year for you. The bank date is the date they processed it, as part of verification on the way to reconciliation to confirm it cleared for the same amount that you thought you spent. The process of settling transactions between banks. Blank Check Illustrations, RoyaltyFree Vector Graphics & Clip Art iStock.

Clearing date means the first business day that the investor holds the purchase notice shares in its brokerage account. Once a trade is executed or completed in a financial market, the clearing agency will be notified, who will then carry out the process of clearing the transaction. However, the holidays will be applicable in only those states where the festivals are observed. In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. How to make a demand draft in PNB Quora.

You Write A Check In Nov, And It Doesn't Get Presented To The Bank Until Jan = The Wrong Tax Year For You.

Clearing is the procedure by which an organization acts as an intermediary and assumes the role of a buyer and seller in a transaction to reconcile orders between transacting parties. Your check date is the date you spent it. However, the holidays will be applicable in only those states where the festivals are observed. If that's not fast enough, try asking customer service or a manager whether there's any.

The Dbs/Posb Cheque Deposit Cut Off Time Is 3.30 Pm And The Fund Is Usually Available For Use The Following Day After 2 Pm.

Unit b, 25/f, mg tower, 133 hoi bun road, kwun tong, In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. National clearing system code starts with 2 character length account identifier (2) iso20022 external account identification codes. Because so many transactions take place between banks on a given day, bank clearing exists to process what each party owes or is owed in a central location so the least amount of money actually changes hands.

The Following Information Applies To Most Of The Banks In Singapore Such As Dbs, Ocbc, Uob, Maybank, Standard Chartered, Etc.

Bank branch code used in taiwan. The first $200 of the total check deposits will be. Clearing date means the date on which the shares clear. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another.

Start Date Jan 6, 2009.

Invoices which were posted on 10/10/1997 and on 10/15/1997 are cleared by a payment document which is posted on 11/10/1997. Clearing date shall be the date in which the estimated put shares (as defined in section 2.2 (a)) have been deposited into the investor 's brokerage account. If the bank fails to clear the cheque within the mentioned period then the bank has to pay interest on the cheque amount. If bank a owes bank b $2 million in cleared checks, but bank b owes bank a $1 million, bank a pays bank b just $1 million.