What is the safest type of bond? There are three types of corporate bonds:

Simple What Are The Different Types Of Government Bonds Idea In 2022, War bonds are used to finance the war effort and are typically sold to the general public. The following are the different types of government bonds.

Bond Dhanvarsha Fincap pvt. ltd. From dhanvarshaindia.com

Bond Dhanvarsha Fincap pvt. ltd. From dhanvarshaindia.com

The reduced yield is attributed to the federal government’s ability to print money and collect tax revenue, which significantly lowers their chance of default. Government bonds are generally the safest, while some corporate bonds are considered the most risky of the commonly known bond types. Issuers sell bonds or other debt instruments to raise money; Details of these investment tools remain clearly mentioned in the nomenclature.

Bond Dhanvarsha Fincap pvt. ltd. Detailed below are the various types of government bonds in india.

War bonds are used to finance the war effort and are typically sold to the general public. All bonds issued by the government are fully. Issuers sell bonds or other debt instruments to raise money; Different types of government bonds,factors affect a government’s debt capacity,influences the credit rating of a government why should you hire expert academic writers?

Source: medium.com

Source: medium.com

Government bonds are generally the safest, while some corporate bonds are considered the most risky of the commonly known bond types. This is called “the coupon” or “ coupon rate.”. The owner of the bond is paid the face value of the bond. War bonds are a type of debt security issued by a government during times of conflict to raise funds in case of war. Bonds — A Primer (part 3). Part 3 — The Government Bond Market by.

Source: youtube.com

Source: youtube.com

Bonds issued by the u.s. Government bonds are issued by governments to pay for services or other obligations. Detailed below are the various types of government bonds in india. Treasury bill does not pay interest to investors. All About Government Bonds YouTube.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

A local government, city or state issues municipal bonds. The highest amount that you can chip in within a year is $10,000 and $5,000 for paper bonds. Detailed below are the various types of government bonds in india. They're a considered to be safe investments, although there's a small risk that the issuer could default on. 6 Types of Investments (To Make The Most Money) Rule 1 Investing.

Source: youtube.com

Source: youtube.com

Treasury bill does not pay interest to investors. It is not that there is no yield; Issuers sell bonds or other debt instruments to raise money; Your guide to the strengths and risks of the most popular types of bonds available: Session 07 Objective 4 Types of Bonds YouTube.

Source: bizfluent.com

Source: bizfluent.com

These are bonds issued by state and native governments. This is called “the coupon” or “ coupon rate.”. They're considered to be very safe investments, since the federal has never defaulted on a bond. They pay you a fixed dividend at regular intervals. Three Types of Government Bonds Bizfluent.

Source: sias.org.sg

Source: sias.org.sg

War bonds are used to finance the war effort and are typically sold to the general public. Details of these investment tools remain clearly mentioned in the nomenclature. Different types of government bonds,factors affect a government’s debt capacity,influences the credit rating of a government why should you hire expert academic writers? The owner of the bond is paid the face value of the bond. Bonds including Singapore Government Securities (SGS).

Source: chihousai.or.jp

Source: chihousai.or.jp

The investors do not get coupon payments. These are bonds issued by state and native governments. Government bonds are generally the safest, while some corporate bonds are considered the most risky of the commonly known bond types. The issuer promises to pay the lender a specified rate of interest during the life of the bond through annual or semiannual payments. Summary of Types of Bonds, Classified by Issuer.

Source: themanatee.net

Source: themanatee.net

This is called “the coupon” or “ coupon rate.”. In this section, we are going to discuss four different types of bond. The lowest amount you can contribute to a savings bond is $25 and $50 for paper bonds. These bonds occur when electrons are transferred from one atom two another, and are a result of the attraction between the resulting oppositely charged ions. NB government selling ‘debt bonds’ as lastminute gift idea The Manatee.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Types of bonds is an important topic with regard to banking awareness and the general awareness part of the various government exams conducted in the country. It is not that there is no yield; Detailed below are the various types of government bonds in india. The reduced yield is attributed to the federal government’s ability to print money and collect tax revenue, which significantly lowers their chance of default. Types of Bonds Boundless Finance.

Source: thestreet.com

Source: thestreet.com

The first option is the series i bond which. Issuers sell bonds or other debt instruments to raise money; Treasury securities are issued by the u.s. A local government, city or state issues municipal bonds. Bonds vs. Stocks What's the Difference? TheStreet.

Source: slideshare.net

Source: slideshare.net

War bonds are a type of debt security issued by a government during times of conflict to raise funds in case of war. Government bonds, also known as sovereign bonds, are debt obligations issued by the national government and are great for deloading some of your portfolio’s risk. Your guide to the strengths and risks of the most popular types of bonds available: Bonds issued by the u.s. Chap 9 bonds.

Source: dhanvarshaindia.com

Source: dhanvarshaindia.com

They are issued for maturity within one year. Government bonds are generally the safest, while some corporate bonds are considered the most risky of the commonly known bond types. Government bonds are issued by governments to pay for services or other obligations. Preferred stocks are technically stocks, but they act like bonds. Bond Dhanvarsha Fincap pvt. ltd..

Source: slideshare.net

Source: slideshare.net

The following are the different types of government bonds. The government establishes the financial requirements for its distribution. These bonds occur when electrons are transferred from one atom two another, and are a result of the attraction between the resulting oppositely charged ions. Treasury are considered to be low risk. Chapter 5 Bond Valuation without Writeups.

Source: aboutsecurityzone.blogspot.com

Source: aboutsecurityzone.blogspot.com

The government establishes the financial requirements for its distribution. The following are the different types of government bonds. Typically they are formed by two (or more. While there are many different types of traditional bonds, you’ll have two options if you want to buy a government bond. About Security Different Types of Bonds Overview Information.

Source: youtube.com

Source: youtube.com

The owner of the bond is paid the face value of the bond. All bonds issued by the government are fully. Three types of government bonds treasury securities or treasurys. These are bonds issued by state and native governments. Types of Bonds YouTube.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

There are a couple of different types of united states savings bonds available for purchase including treasury bonds, i savings bonds, and ee/e savings bonds. A local government, city or state issues municipal bonds. Their purpose is to generate money for. Here is a listing of the various types of government bonds. Overview of Bonds Boundless Accounting.

Source: tsgwm.com

Source: tsgwm.com

War bonds are a type of debt security issued by a government during times of conflict to raise funds in case of war. The first option is the series i bond which. War bonds are used to finance the war effort and are typically sold to the general public. Bonds issued by the u.s. What Types of Bonds Are Available? TSG Wealth Management.

Source: in.pinterest.com

Source: in.pinterest.com

The owner of the bond is paid the face value of the bond. The investors do not get coupon payments. Government bonds, also known as sovereign bonds, are debt obligations issued by the national government and are great for deloading some of your portfolio’s risk. Detailed below are the various types of government bonds in india. " Types Of Investment " via secure247trade Government bonds.

Source: coincommunity.com

Source: coincommunity.com

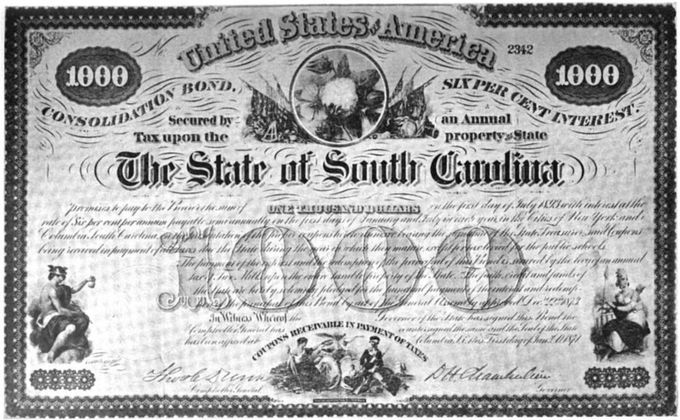

It remains constant throughout the tenure, regardless of market fluctuations. The following are the different types of government bonds. The government establishes the financial requirements for its distribution. There are three types of corporate bonds: Government Bonds Of All Types Coin Community Forum.

Source: cpressrelease.com

Source: cpressrelease.com

The difference will be the yield for the investor. There are a couple of different types of united states savings bonds available for purchase including treasury bonds, i savings bonds, and ee/e savings bonds. It will require you to research or burn your brain power, write your findings down, edit, proofread severally, and submit unsure of the grade you will get. Detailed below are the various types of government bonds in india. Belize to Commence Discussions with Bondholders Caribbean Press Release.

Source: trickyfinance.com

Source: trickyfinance.com

Preferred stocks are technically stocks, but they act like bonds. It remains constant throughout the tenure, regardless of market fluctuations. While there are many different types of traditional bonds, you’ll have two options if you want to buy a government bond. The following are the types of government bonds offered by the reserve bank of india; Savings Bonds Types and Informative Facts You need to Know.

Source: napkinfinance.com

Source: napkinfinance.com

The government establishes the financial requirements for its distribution. A local government, city or state issues municipal bonds. Savings bonds, tips and strips, agency securities, municipal bonds, corporate bonds. In this section, we are going to discuss four different types of bond. Municipal Bonds Napkin Finance.

Source: coincommunity.com

Source: coincommunity.com

All bonds issued by the government are fully. It will require you to research or burn your brain power, write your findings down, edit, proofread severally, and submit unsure of the grade you will get. Federal government bonds in the united states include savings bonds, treasury bonds and. Detailed below are the various types of government bonds in india. Government Bonds Of All Types Coin Community Forum.

Source: coincommunity.com

Source: coincommunity.com

Treasury bill does not pay interest to investors. These bonds occur when electrons are transferred from one atom two another, and are a result of the attraction between the resulting oppositely charged ions. Bonds issued by the u.s. There are a couple of different types of united states savings bonds available for purchase including treasury bonds, i savings bonds, and ee/e savings bonds. Government Bonds Of All Types Coin Community Forum.

Source: pinterest.com

Source: pinterest.com

Savings bonds, tips and strips, agency securities, municipal bonds, corporate bonds. What is the safest type of bond? They are issued for maturity within one year. The investors do not get coupon payments. Differences Between Stocks and Bonds Stocks and bonds, Finance.

They Are Issued For Maturity Within One Year.

They're considered to be very safe investments, since the federal has never defaulted on a bond. What is the safest type of bond? The lowest amount you can contribute to a savings bond is $25 and $50 for paper bonds. Treasury securities are issued by the u.s.

War Bonds Are A Type Of Debt Security Issued By A Government During Times Of Conflict To Raise Funds In Case Of War.

These are bonds issued by the federal. Government bonds are generally the safest, while some corporate bonds are considered the most risky of the commonly known bond types. The government establishes the financial requirements for its distribution. There are three main types of bonds:

While There Are Many Different Types Of Traditional Bonds, You’ll Have Two Options If You Want To Buy A Government Bond.

The reduced yield is attributed to the federal government’s ability to print money and collect tax revenue, which significantly lowers their chance of default. 91 days, 182 days and 364 days. The government issues these bonds in three categories, i.e. Issuers sell bonds or other debt instruments to raise money;

Different Types Of Government Bonds,Factors Affect A Government’s Debt Capacity,Influences The Credit Rating Of A Government Why Should You Hire Expert Academic Writers?

It is not that there is no yield; Here is a listing of the various types of government bonds. Detailed below are the various types of government bonds in india. Typically they are formed by two (or more.