A bank refers to checking accounts as demand deposits. Banks want to make it.

Simple Basic Checking Account Definition Free Download, While these can be used for purchases, the. A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded.

What is a Handheld Calculator? (with pictures) From wisegeek.com

What is a Handheld Calculator? (with pictures) From wisegeek.com

Additionally, it provides superior liquidity. However, depending on the institution at which a checking account is located, the federal government guarantees the deposited funds, up to a preset maximum level. Checking account definition the bank account on which checks are written or drawn. Checking accounts allow you to easily access your money in a variety of ways.

What is a Handheld Calculator? (with pictures) The meaning of checking account is a bank account against which the depositor can draw checks.

When you need to make a purchase, you can access your money using a debit card, a. § understand basic information about checking accounts § use a checklist to help prepare you to open a checking account and determine if the account is right for you what students will do § read a text with basic information about checking accounts. When you sign up for a checking account, you’ll be linked to your bank’s online features too, so you’ll be able to transfer money to other accounts and pay bills from your checking account, all without ever having to write a check. A bank refers to checking accounts as demand deposits.

Source: study.com

Source: study.com

A checking account is also called a transactional account or a. Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of the bancorp bank (“bank”). A checking account is a deposit account, a bank account that allows you to hold and withdraw money. A checking account is a bank account in which a company deposits money and can subsequently withdraw the money by writing a check, using a debit card, arranging for electronic transfers, etc. What is a Checking Account? Definition, Types & Advantages Video.

Source: eupaymentz.com

Source: eupaymentz.com

Checking accounts keep your money safe until you need it. A checking account is a bank account that allows multiple deposits and withdrawals. Plus, some even pay interest to help your money grow. Checking accounts allow you to easily access your money in a variety of ways. What Is A Wire Transfer • How To Wire Transfer Money • EU Paymentz.

Source: study.com

Source: study.com

Interest checking accounts are very similar to standard checking accounts, with one key difference:. A checking account is a type of bank account that allows you to easily deposit and withdraw money for daily transactions. On the next line, write out,. This may include depositing a. Quiz & Worksheet Checking Account Types & Advantages.

Source: forbes.com

Source: forbes.com

Plus, some even pay interest to help your money grow. Different types of checking accounts standard or traditional checking. Banks usually charge between $5 and $15 per month for this fee. Different types of checking accounts basic checking is a regular account for depositing money and making purchases. 6 Types Of Checking Accounts Forbes Advisor.

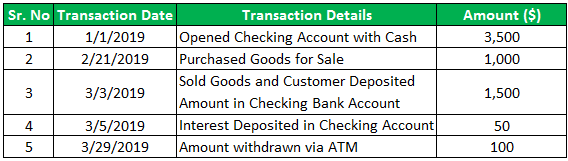

Source: wallstreetmojo.com

Source: wallstreetmojo.com

A checking account is a bank account in which a company deposits money and can subsequently withdraw the money by writing a check, using a debit card, arranging for electronic transfers, etc. A bank refers to checking accounts as demand deposits. A checking account is a type of bank account that allows you to easily deposit and withdraw money for daily transactions. A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded. Money Market Account (Definition, Examples) How it Works?.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The meaning of checking account is a bank account against which the depositor can draw checks. Operating account means a demand deposit account maintained at the funding bank in borrower's name and designated for funding that portion of each eligible loan not funded by a warehousing advance made against that eligible loan and for returning any excess payment from an investor for a pledged loan or pledged security. When you sign up for a checking account, you’ll be linked to your bank’s online features too, so you’ll be able to transfer money to other accounts and pay bills from your checking account, all without ever having to write a check. A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded. Checking Account (Definition, Types) Examples of Checking Account.

Source: accountingformanagement.org

Source: accountingformanagement.org

When you need to make a purchase, you can access your money using a debit card, a. Parts of a check made simple; Operating account means a demand deposit account maintained at the funding bank in borrower's name and designated for funding that portion of each eligible loan not funded by a warehousing advance made against that eligible loan and for returning any excess payment from an investor for a pledged loan or pledged security. Different types of checking accounts basic checking is a regular account for depositing money and making purchases. Account sales definition, explanation, format and example.

Source: slideserve.com

Source: slideserve.com

Often you’ll only be given a cash card rather than a debit card, meaning you can use an atm, but. Means a deposit account on which the consumer is permitted to make payments or transfers by check, money order, or other negotiable instruments and which is maintained by such person for personal, family, or household purposes. While these can be used for purchases, the. Different types of checking accounts standard or traditional checking. PPT Overdraft PowerPoint Presentation, free download ID1954506.

Source: investopedia.com

Source: investopedia.com

Checking accounts allow you to easily access your money in a variety of ways. Checking accounts keep your money liquid, meaning it's easily available when you need it. Often you’ll only be given a cash card rather than a debit card, meaning you can use an atm, but. Different types of checking accounts basic checking is a regular account for depositing money and making purchases. Checking Account Video Investopedia.

Source: sophia.org

Source: sophia.org

Checking account definition the bank account on which checks are written or drawn. Checking accounts are simple by design and if you can afford to have one you should. This may include depositing a. Interest checking accounts are very similar to standard checking accounts, with one key difference:. Checking Accounts Tutorial Sophia Learning.

Source: paraantonia.blogspot.com

Source: paraantonia.blogspot.com

Except for the uncollected funds associated with recently deposited checks from customers, the money in a checking account. A § engage in a simulation activity about meeting There is usually a minimum balance and. Operating account means a demand deposit account maintained at the funding bank in borrower's name and designated for funding that portion of each eligible loan not funded by a warehousing advance made against that eligible loan and for returning any excess payment from an investor for a pledged loan or pledged security. ☑ Ledger Balance Meaning.

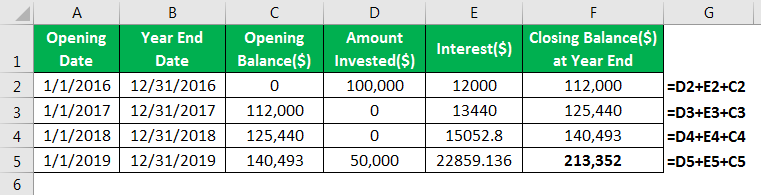

Source: wallstreetmojo.com

Source: wallstreetmojo.com

A bank refers to checking accounts as demand deposits. The account holder can quickly deposit and withdraw funds multiple times using atm, net banking, wire transfer, cheques, credit cards, and debit cards. A checking account is a bank account in which a company deposits money and can subsequently withdraw the money by writing a check, using a debit card, arranging for electronic transfers, etc. Interest checking accounts are very similar to standard checking accounts, with one key difference:. Checking Account (Definition, Types) Examples of Checking Account.

Source: investopedia.com

Source: investopedia.com

The account holder can quickly deposit and withdraw funds multiple times using atm, net banking, wire transfer, cheques, credit cards, and debit cards. A checking account is a variety of deposit accounts held by a bank or credit union (financial institution) that allows a customer to deposit and/or withdrawal funds on a normal basis.checking accounts are considered to be the most liquidvariety of deposit accounts in that the funds are available immediately and are accessible through a variety of withdrawal methods. When you sign up for a checking account, you’ll be linked to your bank’s online features too, so you’ll be able to transfer money to other accounts and pay bills from your checking account, all without ever having to write a check. While these can be used for purchases, the. Bounced Check Definition.

Source: investopedia.com

Source: investopedia.com

However, depending on the institution at which a checking account is located, the federal government guarantees the deposited funds, up to a preset maximum level. Different types of checking accounts basic checking is a regular account for depositing money and making purchases. When you need to make a purchase, you can access your money using a debit card, a. You can access your money with a debit card,. Account Number Definition.

Source: thebalance.com

Source: thebalance.com

A checking account is a type of bank account that allows you to easily deposit and withdraw money for daily transactions. Checking accounts keep your money safe until you need it. While these can be used for purchases, the. Accounts receivable ( ar) tracks the money owed to a person or business by its debtors. Checking Account Definition and Tips.

Source: banking.about.com

Source: banking.about.com

§ understand basic information about checking accounts § use a checklist to help prepare you to open a checking account and determine if the account is right for you what students will do § read a text with basic information about checking accounts. Operating account means a demand deposit account maintained at the funding bank in borrower's name and designated for funding that portion of each eligible loan not funded by a warehousing advance made against that eligible loan and for returning any excess payment from an investor for a pledged loan or pledged security. While these can be used for purchases, the. There is usually a minimum balance and. Parts of a Check and Where to Find Information.

Source: investopedia.com

Source: investopedia.com

Checking account definition the bank account on which checks are written or drawn. Often you’ll only be given a cash card rather than a debit card, meaning you can use an atm, but. These accounts are designed to make it easy to receive and spend your money. Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current. Account Statement Definition & Examples.

Source: banking.about.com

Source: banking.about.com

Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current. When you sign up for a checking account, you’ll be linked to your bank’s online features too, so you’ll be able to transfer money to other accounts and pay bills from your checking account, all without ever having to write a check. Additionally, it provides superior liquidity. A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded. Parts of a Check Where to Find Info on Checks.

Source: varomoney.com

Source: varomoney.com

These accounts are designed to make it easy to receive and spend your money. Interest checking accounts are very similar to standard checking accounts, with one key difference:. Banks usually charge between $5 and $15 per month for this fee. A checking account is a variety of deposit accounts held by a bank or credit union (financial institution) that allows a customer to deposit and/or withdrawal funds on a normal basis.checking accounts are considered to be the most liquidvariety of deposit accounts in that the funds are available immediately and are accessible through a variety of withdrawal methods. Checking Account Definition and Basics Varo Bank.

Source: thebalance.com

Source: thebalance.com

The account holder can quickly deposit and withdraw funds multiple times using atm, net banking, wire transfer, cheques, credit cards, and debit cards. This type of account pays little or no interest. You can access your money with a debit card,. Accounts receivable ( ar) tracks the money owed to a person or business by its debtors. Money Market Accounts Definition, Pros, and Cons.

Source: wisegeek.com

Source: wisegeek.com

Parts of a check made simple; A bank refers to checking accounts as demand deposits. Accounts receivable are sometimes called trade receivables. in most cases, accounts receivable derive from products or services supplied on credit or without an upfront payment. The meaning of checking account is a bank account against which the depositor can draw checks. What is a Handheld Calculator? (with pictures).

Source: youtube.com

Source: youtube.com

Banks usually charge between $5 and $15 per month for this fee. Banking is becoming more and more prevalent on the digital platform and in the digital realm. The bank at which a checking account resides can impose a number of fees on the account holder. Simply put, a checking account is a bank account designed to be used for everyday expenses. What is the meaning of an account in accounting YouTube.

Source: technofunc.com

Source: technofunc.com

Checking account definition the bank account on which checks are written or drawn. Checking accounts keep your money safe until you need it. Interest checking accounts are very similar to standard checking accounts, with one key difference:. Checking accounts keep your money liquid, meaning it's easily available when you need it. TechnoFunc Definition of Bank Meaning of the term Bank and the.

Source: efinancemanagement.com

Source: efinancemanagement.com

When you need to make a purchase, you can access your money using a debit card, a. The bank at which a checking account resides can impose a number of fees on the account holder. Parts of a check made simple; Banks usually charge between $5 and $15 per month for this fee. Working Capital Financing / Loans Types CC/OD, BG, LC, WC Loans, etc.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

This may include depositing a. The meaning of checking account is a bank account against which the depositor can draw checks. These fees cover the costs of managing your checking account. Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current. Checking Account (Definition, Types) Examples of Checking Account.

There Is Usually A Minimum Balance And.

And then allow you easy access when the time comes. Checking accounts allow you to easily access your money in a variety of ways. Additionally, it provides superior liquidity. The account holder can quickly deposit and withdraw funds multiple times using atm, net banking, wire transfer, cheques, credit cards, and debit cards.

A Standard Checking Account Is A Basic Checking Account You Can Use To Pay Bills,.

A bank refers to checking accounts as demand deposits. The meaning of checking account is a bank account against which the depositor can draw checks. You’ll be able to withdraw money from and deposit it into a basic bank account, but you won’t, for example, get a cheque book or be offered an overdraft. Operating account means a demand deposit account maintained at the funding bank in borrower's name and designated for funding that portion of each eligible loan not funded by a warehousing advance made against that eligible loan and for returning any excess payment from an investor for a pledged loan or pledged security.

Parts Of A Check Made Simple;

A checking account is a type of bank account that allows you to easily deposit and withdraw money for daily transactions. Accounts receivable are sometimes called trade receivables. in most cases, accounts receivable derive from products or services supplied on credit or without an upfront payment. Simply put, a checking account is a bank account designed to be used for everyday expenses. When you sign up for a checking account, you’ll be linked to your bank’s online features too, so you’ll be able to transfer money to other accounts and pay bills from your checking account, all without ever having to write a check.

You Can Access Your Money With A Debit Card,.

Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current. On the next line, write out,. However, depending on the institution at which a checking account is located, the federal government guarantees the deposited funds, up to a preset maximum level. Banking is becoming more and more prevalent on the digital platform and in the digital realm.